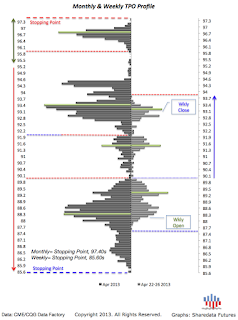

Our weekly TPO profile graphics for 26Apr.

Plotted are Structural Support (blue), Resistance (red), and Points of Control (green).

The graphs show the monthly timeframe sellside auction and the

Stopping Point development at/near 86s within the April distribution (left). Last week's

Directional Phase development following breakout above the Balance High, 89.50s,

is evident on the weekly timeframe distribution (right).

Our weekly statistical study plotting the key reference levels/weekly close for 26Apr, projected levels and inferential analysis for week ending 03May.

Result?...

The market began the week auctioning higher from last week's Settlement, 92.26s, toward the Key Structural Resistance, 94.70s, coinciding with the Weekly 2nd Std Dev High Level, 94.74s. The market achieved the Stopping Point & Balance here before the initiated selling entered the market, driving price through all Statistical Support Levels achieving the Stopping Point at/near Key Structural Support, 90s, into midweek.

Following a brief Balance Phase at/near the Low, the initiated buying entered the market, driving price back up the week's range ultimately extending the range higher toward the Major Overhead Supply Cluster, 96s-97.50s, closing the week at/near 95.60s.

These studies helped inform our subscribers of the Structural Development of a Directional Phase following the breakout of the Balance Phase, 86s-89.50s. The development of a new Directional Phase implied a high probability of continued price discovery higher. Additionally, knowledge of both the key Structural & Statistical Levels provided quantifiable, potential destinations and strategy (in this case long positions into Wkly 2nd Std Dev High, 94.75s, early week/possible short positions on failure there, and/or re-establishing/initiation of long positions on the pullback and buyside defense of the Key Structural Support at/near 90s) in congruence with the market structure.

A holistic view based on the market generated data and probability logic.

For additional information & a 1 week free trial,

please visit our subscription page.