|

|

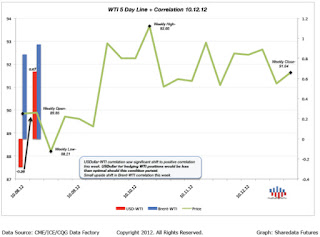

| The Brent-WTI spread closer marginally higher this week at/near $22.76. The inability of the buyside to drive the market above the near term supply cluster from $91-93s is worth noting in light of the rising spread condition. Middle East tensions, Elections, and the Earnings season narrative may provide next directional phase from the balance of $88-93s. |

|

| Source: EIA (October 2012) |

Central Banks

- Negative Real Rates Distorting Market Price Mechanism? (IEA/FT Alpha)

- Why So High The CNY? (FT Beyond BRICs)

- LIBOR-Gate Comes to Crude: Price Fixing In OTC By PRAs? (Zerohedge)

- Pentagon Deploys SF To Jordan-Syria Border. (RT)